montgomery al sales tax registration

This is the total of state county and city sales tax rates. Sales tax is a privilege tax imposed on the retail sale of tangible personal property sold in Alabama.

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Report an Issue.

. The December 2020 total local sales tax rate was also 10000. SalesSellers UseConsumers Use Tax Form. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. The State of Alabama also has a Certificate of. By businesses located in Alabama.

In order to minimize processing time please present your tag renewal notice previous registration receipt or tag number and your Alabama driver license or non-driver ID. Depending on the type of business where youre doing business and other. Taxpayer Bill of Rights.

334-625-2994 Hours 730 am. Once you register online it takes 3-5 days to receive an account number. The Alabama sales tax rate is currently.

In all likelihood the Application For SalesUse Tax Registration is not the only document you should review as you seek business. In addition to the State Sales Tax local sales taxes are also due and these rates vary. Motor FuelGasolineOther Fuel Tax Form.

The State of Alabama administers over 200 different city and county sales taxes. Montgomery AL 36132-7790 About the Division Sales and Use Tax administers sales tax consumers tax sellers use tax simplified sellers use tax rental tax lodgings tax utility taxes. Box 5070 Montgomery AL 36101.

The standard rate of tax is 2300. Type of TaxTax Area A Gross Taxable Amount B Total Deductions C Net Taxable A-B D Tax Rate E Gross Tax Due C x D Sales Tax a. Montgomery AL Sales Tax Rate The current total local sales tax rate in Montgomery AL is 10000.

To report a criminal tax violation please call 251 344-4737. Montgomery AL 36104 Phone. Type of TaxTax Area A Gross Taxable Amount B Total Deductions C Net Taxable A-B D Tax Rate E Gross Tax Due C x D Sales Tax a.

Request BirthDeath Certificates. Montgomery AL Application For SalesUse Tax Registration. The tax is collected by the seller from their.

An annual registration fee or tax on each motor vehicle operated upon the public state highways of Alabama. To report non-filers please email. A Montgomery Alabama Sales Tax Permit can only be obtained through an authorized government agency.

3055 Woodley Rd Montgomery Al 36116 Profitable C Store Loopnet

Frank M Johnson Jr Federal Building And U S Courthouse Montgomery Al Gsa

Title Application Alabama Fill Out Sign Online Dochub

Acrp Pilgrimage To Eji Montgomery Alabama City Of Alexandria Va

Download Instructions For Form S U Bond Sales Tax Surety Bond Pdf Templateroller

Alabama Tax Title Registration Requirements Process Street

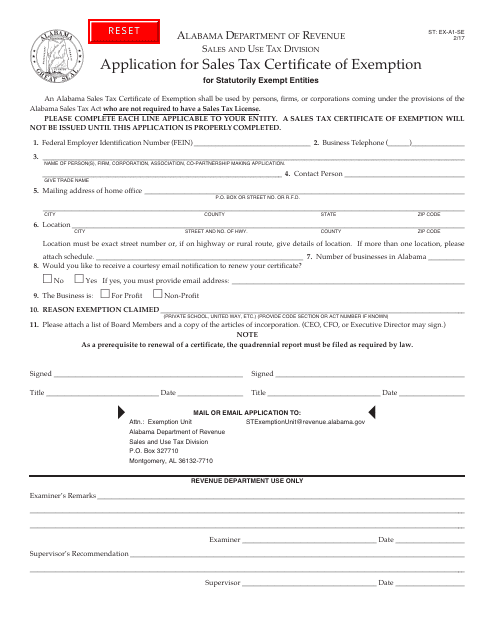

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

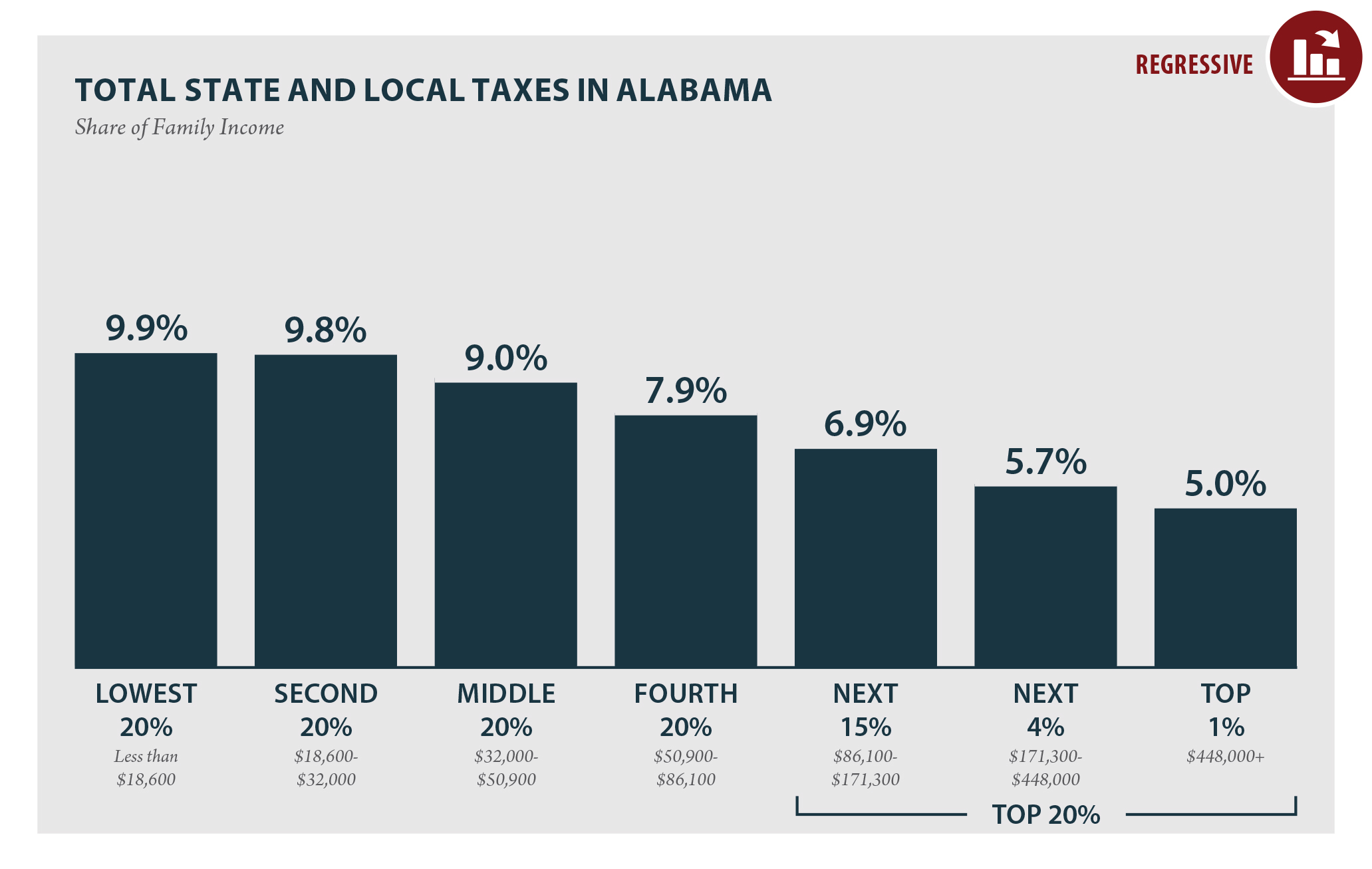

The Less You Make The More You Pay Alabama S Taxes Remain Upside Down Alabama Arise

State Sales Tax Exemption Alabamapta

Infiniti Dealership In Montgomery Al Seving Montgomery And Birmingham Infiniti Of Montgomery

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Alabama Department Of Revenue Montgomery Al

Alabama Combined Registration Application Form Fill Out Sign Online Dochub

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Alabama Sales Tax Guide And Calculator 2022 Taxjar

How To Register For A Sales Tax Permit In Alabama Taxvalet

Application For Sales Tax Certificate Of Exemption Alabama