when are property taxes due in chicago illinois

1 day agoFor couples who file jointly for tax year 2023 the standard deduction increases to 27700 up 1800 from tax year 2022 the IRS announced. Explore the Map and Data.

Baker Tilly Illinois Baker Tilly Advisory Tax And Assurance Baker Tilly

You were an Illinois resident in 2021 and your adjusted gross income on your 2021 Form IL-1040 is under 400000 if filing jointly or under 200000 if youre filing as a single.

. Tax Extension and Rates The Clerks Tax Extension Unit is responsible for calculating property tax rates for all local taxing. Accorded by Illinois law the government of Chicago public. The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendozas office said in a news release.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. Late payments will be charged 15 per. How Wealthy Investors are Making.

There are three basic phases in taxing real estate ie setting levy rates estimating property values and receiving payments. Has yet to be determined. Lucrative loophole benefits delinquent property tax buyers in Cook County at expense of government taxpayers new study says.

Property Tax 101 An overview of the Illinois Property Tax system. Single taxpayers and married. How Wealthy Investors are Making Millions Exploiting Illinois Property Tax Law Executive Summary.

173 of home value. Private investors are exploiting an arcane Illinois law to profit from the property tax debt owed on thousands of properties fueling disinvestment in communities that are home. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

An extra 939 million in property taxes will be collected this year to support the city of Chicago. Tax amount varies by county. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the.

To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500000 or less if filing jointly. The mailing of the bills is dependent on the completion of data by other local. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system.

2019 payable 2020 tax bills are being mailed May 1. Tax Year 2021 Second Installment Property Tax Due Date. A letter obtained by the ABC 7 I-Team from Cook County Clerk Karen Yarbrough and Treasurer Maria Pappas asked Kaegi Tuesday to sign a document asserting that his office.

The Portal consolidates information and delivers. Cook County Treasurer Maria Pappas and her office have sent out the second property tax bill installment which is due October 1. March 2 is when the first property tax payment is due in Cook County.

Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

Late Property Tax Bills In Cook Co Still Not Ready

Your Assessment Notice And Tax Bill Cook County Assessor S Office

1235 1237 N Ashland Ave Chicago Il 60622 Loopnet

Commercial Property Owners Want An Equitable Balance Crain S Chicago Business

Trump Owed 1 Million Tax Refund In Chicago Official Tries To Stop It

Austintalks Get Help Lowering Your Property Taxes Austintalks

5225 5253 W Madison St Chicago Il 60644 Loopnet

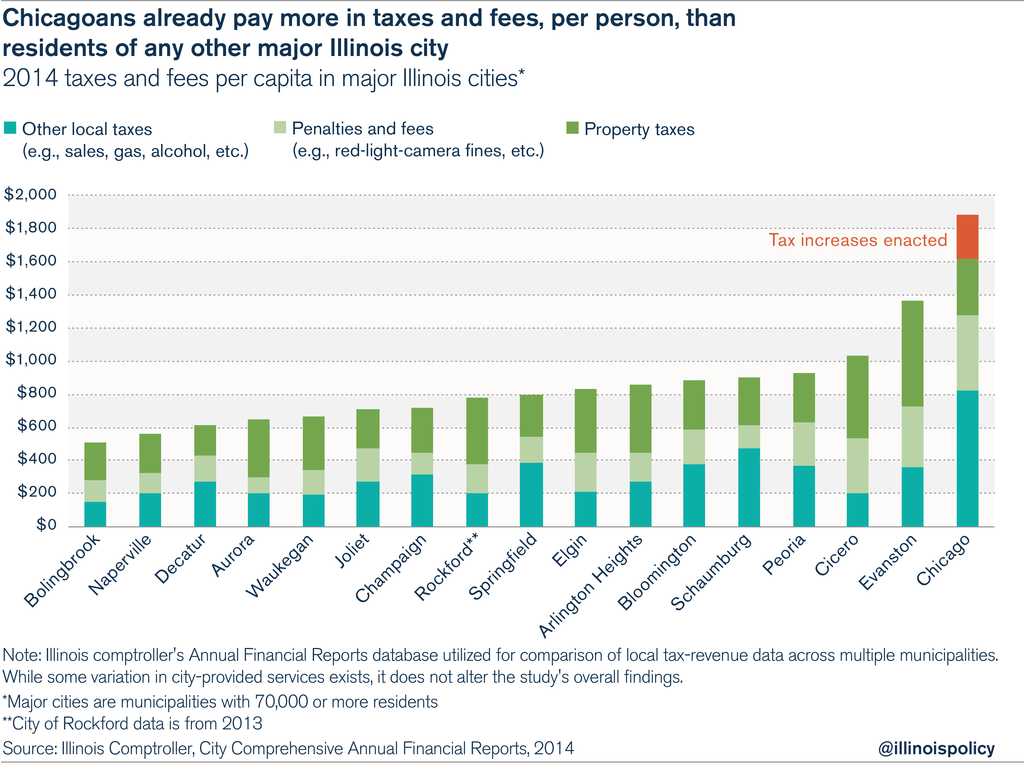

The Chicago Squeeze Property Taxes Fees And Over 30 Individual Taxes Crush City Residents

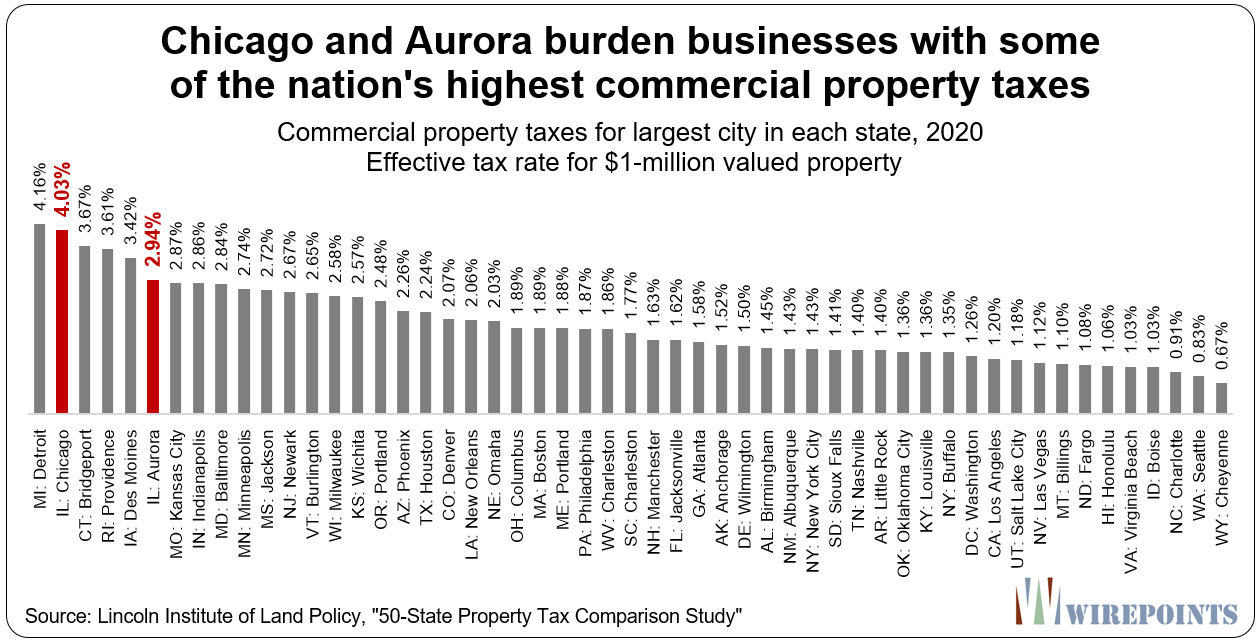

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Wirepoints Wirepoints

Cook County 2nd Installment 2021 Tax Bills Delayed Lp

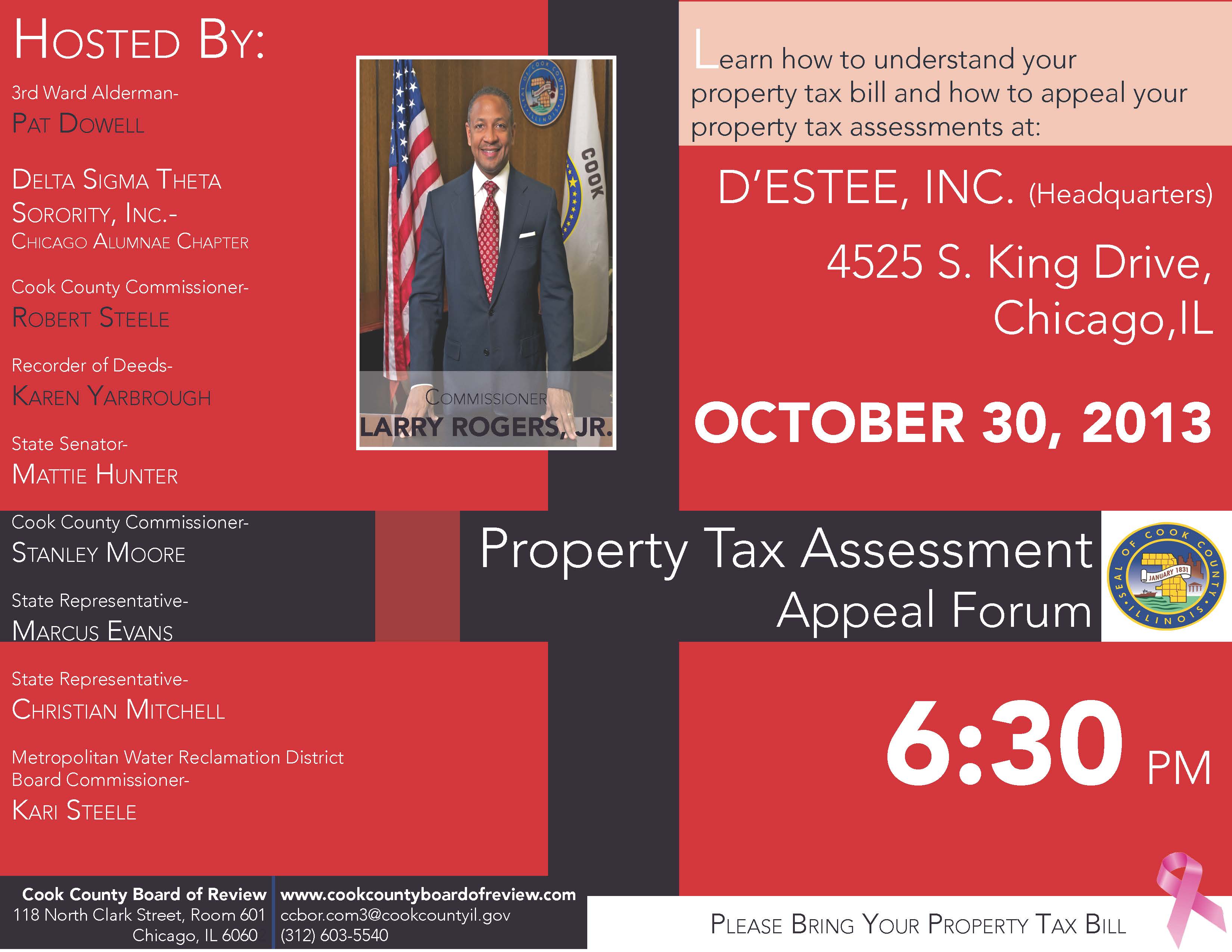

Hunter Partners With Cook County Board Of Review Commissioner Larry Rogers Jr To Assist Taxpayers To Combat Property Taxes

Cook County Likely To Again Delay Property Tax Payment Deadline Crain S Chicago Business

There S Help For Senior Citizens Struggling To Pay Cook County Property Taxes Building A Better 7th Together

0 1 Acres Of Land For Sale In Chicago Illinois Landsearch

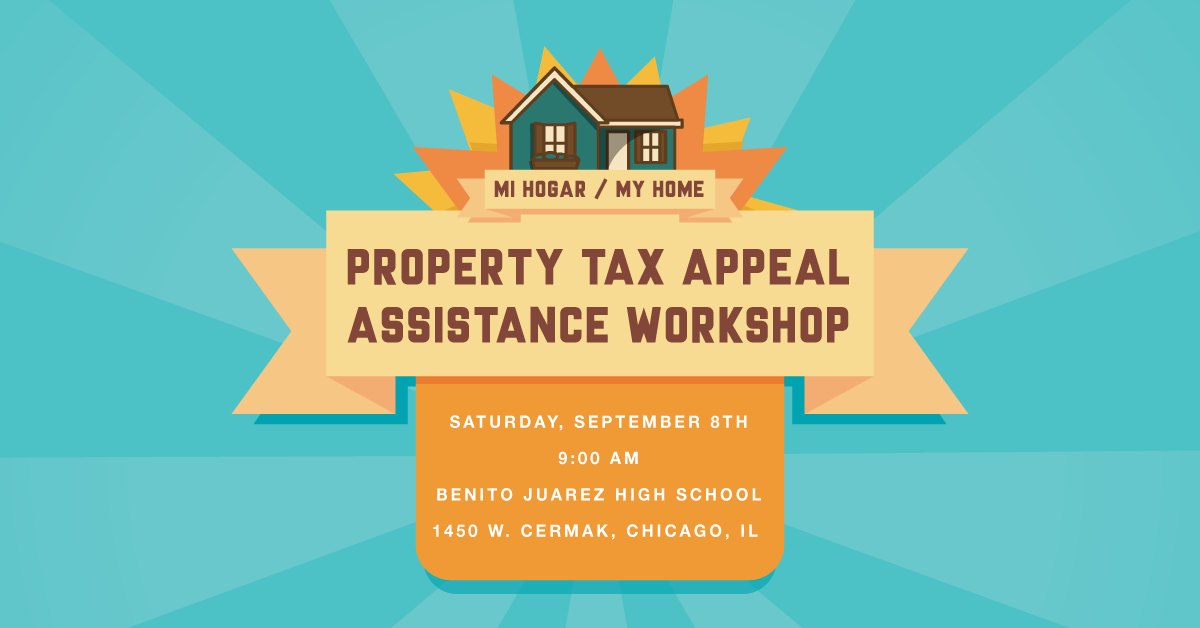

Pilsen Planning Committee Housing Task Force Led By Trp To Host Educational Workshop Urging Homeowners To Appeal Property Taxes Prior To September 25th Deadline The Resurrection Project

Tone Deaf Proposal Increase Illinois Property Taxes To Pay Pension Debt Illinois Opportunity Project

3507 N Neenah Ave Chicago Il 60634 Mls 11483372 Trulia

2018 Money Smart Week Property Tax Sessions Raila Associates P C

13 Best Chicago Suburbs Of 2022 Map Top Chicago Suburb For Families