michigan property tax rates 2020

The IRS will start accepting eFiled tax returns in January 2020. Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan.

All It Takes Is A Big Unexpected Expense Or A Few Months Of Unemployment And You Re Behind On Your Mortgage Or Tax Pa Tax Payment Unexpected Expenses Mortgage

When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes.

. To add more confusion to the process is every city does their wintersummer taxes differently. 28 2020 121 pm. Michigan Taxes tax income tax business tax sales tax tax form 1040 w9 treasury withholding.

Rates include the 1 property tax administration fee. The average millage rate in Michigan was 42. When comparing Michigan real property tax rates its helpful to review effective tax rates which is the annual amount paid as a percentage of the home value.

But rates vary from county to county. Under the Tax Tribunal Act the interest rate for property tax refunds was 331 for calendar year 2009 123 for calendar year 2010 112 for calendar year 2011 and will be 109 for 2012. Michigan has some of the highest property taxes in the nation as measured by average effective property taxes thats total taxes paid as a percentage of the homes market value.

Our Michigan property tax bills cover. Michigan Extends 2020 Property Tax Appeal Deadline. The 2020 average property tax bill in Michigan was about 2150 on an owner-occupied home according to data from the Michigan Department of Treasury.

On average residents of the Great Lakes State pay 145 of their home. Michigans effective real property tax rate is 164. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

Various millage rate exports are available under the Review Reports section. The property tax rate in Michigan is referred to as a millage and its figured in mills. Principal Real Property Tax Rate Mills Levied.

Before the official 2022 Michigan income tax rates are released provisional 2022 tax rates are based on Michigan. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected. Or more simply for every 1000 in taxable value a property owner will pay 1 in property tax.

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Michigan has some of the highest property tax rates in the country.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. Additional millage information can be found on our eEqualization website. One mill is equal to 11000 of a dollar.

Thats based on an average homestead tax rate. This booklet contains information for your 2022 Michigan property taxes and 2021 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program. Principal Real Property Tax Rate Mills Levied for 2020pdf.

They run a full year. The summer tax bill runs from July 1st of this year to June 30th of next year. Rates for 2021 will be posted in August 2022.

Gasoline Tax g 10130 10904 0263gal. New Developments for Tax Year 2021. Sales of electricity natural gas and home heating fuels are taxed at a 4 rate.

Property Tax Forfeiture and Foreclosure Reports and Legal Taxes. Millage rates are those levied and billed in 2020. 2020 Millage Rates - A Complete List.

2019 Millage Rates - A Complete List. In contrast if taxpayers pay their taxes late they are charged interest rates. UPDATED june 2020.

2005 Millage Rates - A Complete List. Use the Guest Login to access the site. 2018 Millage Rates.

Michigan Business Tax Michigan Business Tax. Heres a list of the 25 Michigan cities and townships with the highest property tax rate for homeowners. For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is 425.

A Consensus Revenue Estimates May 15 2020. The winter tax bill runs from December 1st of this year to November 30th of next year. Individual Income Tax.

The Great Lake States average effective property tax rate is 145 well above the national average of 107. In fact there are two different numbers that reflect your homes value on your Michigan real property tax bill. For the category select Excel Exports then select the desired report from the report drop-down list.

Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 193869 373869 133869 253869 193869 373869 Caledonia Twp 011020 ALCONA COMMUNITY SCH 188531 368531 128531 248531 188531 368531 Curtis Twp 011030 OSCODA AREA SCHOOLS 200781. Rates include special assessments levied on a millage basis and levied in all of a township city or village. Form MI-1040 - Individual Income Tax Return.

Pin On Financial Planning Tips

Deducting Property Taxes H R Block

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Kingston Property Tax 2021 Calculator Rates Wowa Ca

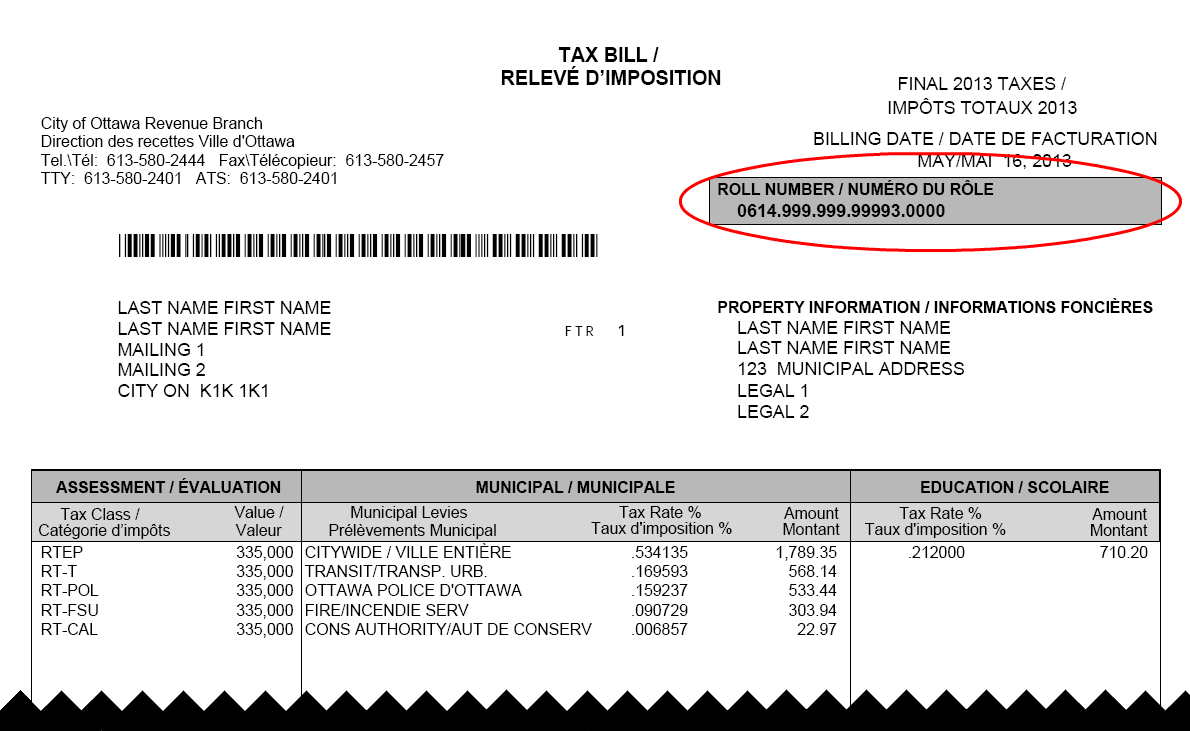

Property Tax Bill City Of Ottawa

Property Tax Comparison By State For Cross State Businesses

Florida Property Tax H R Block

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Tax How To Calculate Local Considerations

Property Taxes How Much Are They In Different States Across The Us

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

How To Calculate Property Tax And How To Estimate Property Taxes

Realtors Expect These Neighborhoods To Sell Big In 2020 The Neighbourhood Real Estate Lake Ontario

Thinking About Moving These States Have The Lowest Property Taxes

Michigan Property Tax H R Block

The Most Tax Friendly States For Retirement Retirement Income Best Places To Retire Retirement

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)